- Breakout Capital Group

- Posts

- The Most Important Part of Any Early-Stage Raise

The Most Important Part of Any Early-Stage Raise

how to build a story, sell yourself to investors, and come across as someone worth backing for investment

The unfortunate reality for most early-stage firms looking to fundraise is that their first 1-2 rounds of capital are more about themselves, and their story than it is their product or revenue.

From the conversations I’ve had with the majority of you from this newsletter looking to go-to-market for your next round, there isn’t enough of a story in place to win over investors.

In our opinion, the most important thing you need to convey to investment groups in your first interactions is that YOU are a person & team worth betting on.

I’m going to breakdown our thesis for how we’re doing this for our clients when they meet with investors to package their story, their credibility, and their vision into something that investors want to bet on:

1) Testing / Feedback Phase

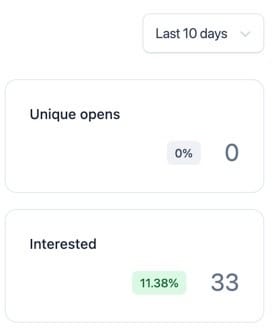

One of the raises we’re taking live right now has booked 20+ intro meetings with investment groups in the first 30 days of being live

What this does for us and our client is gets them direct feedback from investment groups on their deck, data room, story, and angle

We’re getting direct insight into the decision-making process of these groups and how they formulate and come up with decisions

With this, we can make tweaks and iterations to our story to closer align with what our investor profile is looking for, since we’ve heard directly from them now

Iteration / Story Re-alignment

Now that we have heard directly from the source of what is “wrong” or “mis-aligned” with our initial raising thesis, our team goes back to the drawing board to update our supplementary material

We cut the things investors didn’t find relevant, and add more detail to the things they honed in on from our first conversation with our client.

Once that new story is fully built out, we embed this into the booking flows of our clients calendar so that as soon as a meeting is scheduled, investors are given the new and updated story so they can come into the meeting with the full picture

This means time is being saved on “so what do you guys do” types of questions, investors already know and understand your thesis, and your call can be spent on high level material, advancing investment conversations forward fast, and efficiently.

Too many people I’ve spoken with are treating their fundraising process like a few coffee chats here and there and are wondering why capital hasn’t fallen from the sky yet.

With the rates at which investment groups are currently deploying, you need a tight, fast, and detailed fundraising process that displays conviction, confidence, and certainty in you and your product.

Hope this helps re-frame your raise based on what we have seen to be important.

If you ever need anything feel free to reach out.

Thanks,

Ryan

Breakout Capital Group